Kahneman, Daniel (2011). Thinking, Fast and Slow. NY: Farrar, Straus and Giroux.

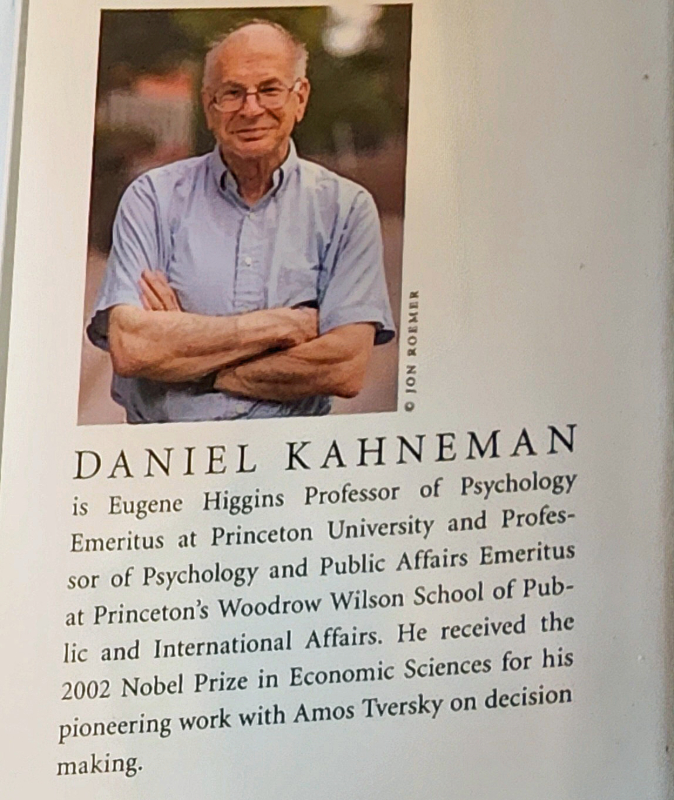

Years ago, Kahneman was interviewed by Ira Flatow, on the radio show, Science Friday. In the interview, he said that people are mistaken to think that by reading this book they won’t make cognitive errors and will think more clearly. He noted that he wrote the book and still makes many cognitive errors. Apparently, being a Nobel laureate didn’t detract from his humility or his sense of humor.

This is Part 3 of 3 parts of my discussion of Daniel Kahneman’s delightful book, Thinking, Fast and Slow. I managed to complete Parts 1 and 2 before having cataracts surgeries on both eyes, but I fell subject to the planning fallacy when thinking I could finish all three parts before the surgery. I couldn’t. Here, at last, is Part 3.

Parts 1 and 2 of my blogs

Here’s what I had written about in the first two parts:

Part 1 of 3: https://bird-brain.org/2025/06/18/thinking-fast-and-slow-by-daniel-kahneman-part-1/

- Introduction, 3–15

- Part I. Two Systems

- Part II. Heuristics and Biases

Part 2 of 3: https://bird-brain.org/2025/06/24/thinking-fast-and-slow-by-daniel-kahneman-part-2/)

- Part III. Overconfidence, 197–265

- Part IV. Choices, 267–374 (25. Bernoulli’s Errors, 269–277 . . . 29. The Fourfold Pattern, 310–321)

Part 3 of 3

In Part 3 of 3, I continue with the book’s Part IV. Choices

- Rare Events, 322–333

- Risk Policies, 334–341

- Keeping Score, 342–352

- Reversals, 353–362

- Frames and Reality, 363–374

Then I finish up with the remainder of his book:

Part V. Two Selves, 375–407

- Two Selves, 377–385

- Life as a Story, 386–390

- Experienced Well-being, 391–397

- Thinking about Life, 398–407

- Conclusions, 408–418

- Appendix A: Judgment under Uncertainty, 419–432

- Appendix B: Choices, Values, and Frames, 433–448

- Notes, 449–481

- Acknowledgments, 483

- Index, 485–499

30. Rare Events, 322–333

Terrorism is effective because it induces an availability cascade, in which a highly vivid image of a terrifying event is repeatedly shown by the media, making the image easily available in your memory. Because the media repeatedly show the image, its availability can’t recede, and the emotional arousal it causes is automatic, out of our conscious control. Though the probabilities of experiencing the event are minuscule, its availability is enormous, and our emotions kick into high gear. The same may be said of threatened invasions by violent immigrant criminals. Though the chances are nearly negligible that a violently criminal immigrant will harm you, the politicians and the media make these possibilities highly available in your memory.

At the opposite end of the spectrum, the media frequently highlight lottery winners, distorting the perceived probability of winning as being far greater than is justified. For both terrorism and lottery winning, the possibility effect overwhelms the imperceptibly slight chance of either occurring to you.

The same is true for personal threats or opportunities. The mere possibility of a harmful event occurring (e.g., cancer, violent attack) can be so alarming that we take irrationally drastic steps to avoid such an occurrence. (Recently, celebrities have been getting full-body MRI — magnetic resonance imaging — scans, despite the tiny chances of the scans revealing any health threat and the likelihood that such a scan will lead to more fruitless testing.)

Similarly, we may unreasonably gamble on the possibility of gaining a huge reward. (For some, the enjoyment of contemplating that possibility is rewarding in itself, which is fine if the cost of doing so doesn’t otherwise diminish the person’s quality of life.) The more vivid the imagery associated with the opportunity or the threat, the more available it is, and the more likely we are to completely ignore the actual minuscule probability of such an event. This effect is enhanced when irrelevant information is added to increase the availability, though it has no effect on the probability. For instance, if a gambler imagines the new car or house she or he would buy with the gains, the availability of that outcome increases, but the probability doesn’t.

Another contributor to this cognitive bias is denominator neglect. For instance, some people may more alarmed by a disease that kills “1,286 out of 10,000 people,” than by one that kills “24.4 out of 100,” though the latter disease is far more deadly. We tend to focus on the numerator — 1,286 or 24.4 — and to neglect the denominator — 10,000 or 100. If, instead, we’re presented with a percentage or a probability for both diseases, we can more readily judge which is truly more deadly. The format for the information we gather can clearly affect how we use it. Another format effect relates to whether we read a description or we see a photo or other image. Images make information far more salient and available than written information.

When we’re planning a project, we can readily call to mind the likelihood of our success and images of how that success will look. We’re less likely to easily picture failure in our endeavor. The vivid images of success increase our likelihood of overestimating our likelihood of success.

The same applies to our recollections of past events. Rare events linked to vivid mental images will be remembered better and will seem more salient than common events that don’t evoke strong mental images. (For instance, you may not be able to remember for sure what you ate for lunch three days ago, but you can probably remember eating your wedding cake long ago, or eating food at a similarly memorable event.)

31. Risk Policies, 334–341

We are risk-averse regarding gains — we’ll choose the sure gain, even if the gains are potentially larger for the uncertain gain. Yet we’re risk-seeking regarding losses — we’ll avoid the sure loss, even if the losses are potentially larger for the uncertain loss. For instance,

- You’d probably choose to be sure to gain $100, rather than to have a 50% chance of gaining $150.

- You’d probably choose having a 50% chance of losing $150, rather than being sure of losing $100.

That is, we’re willing to pay a premium for a sure gain and to pay a premium to avoid a sure loss.

If you’re making multiple gambles, one way of dealing with these irrational views of risk is to repeat to yourself, “You win a few, you lose a few.” This “mantra” helps under these circumstances:

- You’re making multiple gambles that are completely independent of one another — that is, the outcome of one gamble doesn’t have any effect on the outcome of any others.

- The possible loss of any of the gambles doesn’t drastically affect your total wealth enough for you to worry.

- You’re not betting on long shots, where the likelihood of winning is extremely small for each bet.

If you’re betting on the stock market (or other investments), “Closely following daily fluctuations is a losing proposition, because the pain of the frequent small losses exceeds the pleasure of the equally frequent small gains” (p. 340). Also, make a commitment not to change your investments for a given period of time in order to improve the performance of your financial investments.

Two more tips from Kahneman:

- Always take the highest possible affordable(!!) deductible on your insurance

- Never buy extended warranties

32. Keeping Score, 342–352

For many of us, more money and higher income aren’t necessary for survival. We seek them in order to increase our sense of achievement and/or our self-regard.

Suppose that you must sell one of your investments:

- You bought Timely Dates, which you could sell now for $5,000 less than you paid for it.

- You also bought sell Dately Times, which you could sell now for $5,000 more than you paid for it.

If you are like most people, you’ll choose to sell Dately Times, rather than Timely Dates. In that way, you’re leaving the investment as a winner, not a loser. BUT this also means that you’re holding onto a stock that’s a proven loser, rather than keeping the stock that’s a proven winner. One aspect of this cognitive shortcut is narrow framing: We view each stock individually, narrowly framing each as a winner or a loser, rather than viewing the entire portfolio as a whole.

It’s also an example of the sunk-cost fallacy, in which we continue to invest in a losing stock, project, relationship, etc., tossing more and more resources into a losing proposition. The likelihood of continuing this losing strategy is increased if we have more of our personal identity and feelings of accomplishment invested in the proposition.

In retrospect, we may view our actions with regret, focusing on how things may have been different if we had made a different choice. Regret will be more intense if our choice was unusual, unexpected, out of the norm. It will be less intense if our choice would have been expected for these circumstances. This is also true for our own behaviors. For instance, suppose that we normally ride the bus to work, but on this day, we decide to drive to work and end up having a car accident. We will probably feel more regret than a person who drives to work every day and ends up having a car accident.

Another factor affecting regret is whether our decision involved taking action, or it involved not having taken action. For instance, suppose that I decide to switch insurance companies, and the new company boosts my rates to $500 more than what I was paying at the old company. Suppose, instead, that I stick with my old insurance company, and it boosts my rates to $500 more than what I would have paid at the new company. Either way, I’m paying an additional $500, but I’ll probably regret my decision more if I switched than if I didn’t switch. We tend to regret more strongly our actions than our inactions. We’re often wary of taking action because we’re aware of this asymmetry of regret.

For some areas of our lives, we’re more averse to risk than for others. For most of us, we’re less willing to take risks regarding our health than regarding our money. This aversion may be especially true for parents, in regard to the health and safety of their children. Kahneman calls this enhanced loss aversion. When making such decisions, we may anticipate regretting the wrong choice, exaggerating our aversion to risk.

33. Reversals, 353–362

We often use context when making comparisons, and we use categories to aid us in these comparisons. For instance, you probably readily answer

- Would you rather eat watermelon or apricots?

- Would you rather eat pizza or hamburgers?

But you might not as quickly answer

- Would you rather eat watermelon or pizza?

The categories we use for concepts or things also affects how we feel about them and how strongly we feel. For instance, most of us would be more willing to donate to a charity that benefitted humans than non-human animals, and to donate to charities for mammals than for invertebrates.

Anchoring, framing, and context also affect judgments for punitive damages. For instance, regarding anchoring, when a high number is proposed for the judgment, compared with a lower number, the judgment will usually end up being higher. Regarding framing, when the current case is considered in relation to a more sympathetic case, the judgment may be lower, whereas when considered in relation to a less sympathetic case, the judgment may be higher. Regarding context, if a particular defendant has been found guilty of negligence or abuse previously, the damage judgments are likely to be higher.

34. Frames and Reality, 363–374

“Logically equivalent statements evoke different reactions” (p. 363). For instance, we don’t respond to “losses” the same way we do “costs.” If we buy a lottery ticket, and we don’t win the lottery, we may view the purchase as a loss — which really hurts — or as a cost — which doesn’t hurt quite as much.

Another example: Credit-card companies work hard to avoid having users focus on how much they’re paying for the use of credit cards, so they persuade gas stations or other retailers to offer “cash discounts,” not “credit surcharges.”

Neuroscientists studied people’s brains while they responded to situations in which they were presented with a gamble: In each gamble, the participants were to receive $50

- KEEP frame: In one situation, they were offered either to keep $20 or to risk either losing the $50 or keeping all $50

- Many participants almost always chose the sure thing, keeping the $20

- LOSE frame: In another situation, they were offered a chance to lose $30 of the $50 or to risk either keeping all $50 or losing all $50

- Many participants almost always chose the risky choice, hoping to win $50

- In addition, many participants made the same choice, regardless of the KEEP/LOSE frame.

When the neuroscientists looked at the participants’ brain activity,

- The brains of participants who avoided risk in the KEEP frame and took a risk in the LOSE frame showed a lot of activity in the amygdala, associated with emotional arousal.

- The brains of participants who refrained from gambling in the LOSE frame showed activity in the angular cingulate, a brain region associated with mental conflict and self-control.

- The brains of participants who were least affected by framing effects in either situation showed high brain activity in the frontal cortex, associated with reasoning in decision making.

Words mean more to us than their literal meaning. We are much more willing to undergo a medical treatment with a 90% survival rate than one with a 10% mortality rate. Even physicians can fall prey to these effects. Similarly, we are much more likely to be risk averse (stick to the sure thing) when considering the likelihood of a good outcome, but much more willing to be risk taking (gamble) when considering the likelihood of a bad outcome. We fiercely avoid sure losses, and we strongly adhere to sure gains.

How things are framed makes a difference in people’s actions, and frames should be considered in making public policy. For instance, when considering car mileage, we would be much more impressed by considering how many gallons we use per mile, than by the current mpg information. Similarly, when organ donation is the default on driver licenses, to which an individual may opt out, it becomes much more frequent than when refusing organ donation is the default, and an individual must opt in.

Part V. Two Selves

35. Two Selves, 377–385

Economists use the term utility to mean “wantability” — how much we want something is its utility. Kahneman uses the term decision utility for this concept.

When retrospectively evaluating a painful experience, we tend to follow the peak–end rule: What was the average of the level of pain, as measured at the peak — most painful moment — and as measured at the end of the experience? Surprisingly this average of the two moments much more powerfully affects our recollection of the experience than the duration of the painful experience, which Kahneman describes as duration neglect.

Kahneman suggests that the experiencing self would want the painful experience to be as brief as possible, with the moment-to-moment pain being as low as possible, at any time during the experience. However, the remembering self wouldn’t pay much attention to the duration of the experience, but would instead focus on the peak moment of greatest pain and on the final moment of the painful experience, averaging those two levels of pain to determine the level of pain for the experience. As you might imagine, the remembering self is the one who keeps score about experiences, learns from those experiences, and makes judgments based on prior experiences, regarding future actions. This might lead us to make decisions such that we will endure pain for longer times than our experiencing self would choose.

Preliminary studies suggest that the same may be true for pleasurable experiences, in that we may remember the intensity of the pleasure (at the peak and at the end) while neglecting the duration of the pleasure. I’m guessing that theme parks take advantage of this cognitive error when devising rides and other experiences.

36. Life as a Story, 386–390

When we listen to stories or create our own stories of our own experiences, we focus mostly on the “significant events and memorable moments, not about time passing. Duration neglect is normal in a story, and the ending often defines its character” (p. 387). This storytelling bias especially applies to our own stories we tell ourselves about our own lives. We want it to be a good story, with a happy ending, and a worthy hero. We show the peak–end effect and duration neglect when recalling our own stories. In assessing our own life stories, peaks and ends matter much more than duration.

Our remembered stories powerfully influence whether we’ll want to repeat an experience. When people’s travel diaries were compared with their recollections of their trips, the diaries often differed greatly from their recollections. Nonetheless, it was their recollections that determined whether they wanted to repeat the experience, even if their actual experiences differed sharply from their recollected experiences.

Kahneman observed, “Odd as it may seem, I am my remembering self, and the experiencing self, who does my living, is like a stranger to me” (p. 390).

37. Experienced Well-being, 391–397

One example of mental or physical well-being is the state of flow, defined by Mihaly Csikszentmihalyi as being so thoroughly enthralled with your current experience — artistic expression, reading a book, solving a puzzle, etc. — that an interruption of your experience is quite unwelcome. Kahneman recalled that when he was a small boy, he would resent it when his mother interrupted him playing with his toys to play in the park, then while playing in the park, he would resent her interrupting him to go home again. At both times, he was in a state of flow.

Studies of people’s satisfaction with their lives yielded some interesting results:

- Unhappiness is not equally distributed; a small proportion of the population suffers more than the rest.

- Emotional well-being fluctuates considerably over each day and over various days of the week, with current mood being closely tied to the current situation.

- Some of the factors that decreased positive mood in the workplace were loud noises, time pressures, and close supervision

- People who ate while doing other tasks (more likely in American women) enjoyed eating less than people who focused only on eating, without doing other tasks (more likely in French women).

- Poor physical health can have dramatic adverse effects on feelings of well-being

- More social contacts with friends and family had beneficial effects on experiences of well-being.

- Though higher educational attainment is associated with “higher evaluation of one’s life,” it’s not associated with greater experiences of well-being (p. 396).

- Money doesn’t buy happiness — except that extreme poverty diminishes happiness. But above that minimum level, greater wealth doesn’t lead to greater happiness. Kahneman calls this level the satiation level, above which increased income or wealth doesn’t affect happiness.

- Perhaps the most dramatic effect on well-being is that people who have more control over what they do with their time (e.g., not having to commute) are happier than people with less control.

38. Thinking about Life, 398–407

According to Daniel Gilbert and Timothy Wilson, “the decision to get married reflects, for many people, a massive error of affective forecasting” (p. 399, emphasis in original): They realize that the divorce rate is about 50%, and that an additional proportion of married people are unhappily married. Nonetheless, they use their own feelings — their affect — to forecast how happy they will be if they marry. In studies of people’s satisfaction with their lives, marriage — on average — neither positively nor negatively affected people’s life satisfaction. This isn’t because it has no effect, but rather because it makes some aspects better and some aspects worse. For any given individual, that balance may skew one way or the other, but the overall average is — no effect.

In regard to questions of life satisfaction, our current mood will affect our answer to that question. If someone greeted us warmly, we may say we feel greater life satisfaction; if someone treated us gruffly just prior to answering the question, we may report less life satisfaction. Kahneman calls this the mood heuristic. How does that happen? When we have a positive experience, and we’re in a positive mood, our memories make available more positive achievements, relationships, and other aspects of our lives. When, instead, we’re in a negative mood, our available memories are more likely to be negative.

Another consideration in life satisfaction is a person’s overall temperament, which seems to have a strong genetic component. Some people are temperamentally happier and are likely to report greater life satisfaction.

Goals also affect life satisfaction. Persons who reported having a goal of earning a high income were more likely to have achieved that goal. In addition, those who had this goal and who had achieved it were more likely to be satisfied with their lives than people who didn’t have this goal or who had this goal and didn’t achieve it. “The people who wanted money and got it were significantly more satisfied than average; those who wanted money and didn’t get it were significantly more dissatisfied” (p. 402).

Money isn’t everything. Pretty much anything we emphasize as being important as a goal will be important in our later satisfaction with our lives. In the focusing illusion, we overemphasize one particular aspect of our lives as being the key to our happiness and feelings of well-being.

Persons who don’t have physical disabilities typically imagine that having such a disability would be a source of constant dissatisfaction and misery. Certainly in the days, weeks, and perhaps months after a crippling accident, a person thinks of little else and focuses on little else, feeling greatly dissatisfied and miserable. Over time, however, most disabled persons get used to their new circumstances, and if they’re not experiencing chronic pain, loud noise, or severe chronic depression, they adjust to their new situation. Kahneman notes that “Pain and noise are biologically set to be signals that attract attention, and depression involves a self-reinforcing cycle of miserable thoughts” (p. 405), making adaptation nearly impossible. “Paraplegics are in a fairly good mood more than half of the time as early as one month following their accident” (p. 405). When doing enjoyable activities with people they enjoy, they have a good time and feel happy. “Adaptation to a new situation, whether good or bad, consists in large part of thinking less and less about it” (p. 405). As an example of adapting to good situations, lottery winners show this same pattern of adaptation.

In thinking about the effects of affective forecasting, Gilbert and Wilson propose that we engage in miswanting. When miswanting, we greatly exaggerate how much a significant purchase or change in circumstances will affect how we feel. We falsely believe that the beautiful new car will make us feel happier with our lives or that being unable to buy a new home will prevent us from feeling happy with our lives. Our imagined joy doesn’t consider the effects of adaptation, becoming accustomed to the new car; the same applies to an imagined obstacle to happiness.

Due to the focusing illusion, we don’t anticipate that the desired goods or experiences will lose their zest over time. In addition, we may fail to appreciate the goods and experiences that might still bring us joy if we focused on them again. (I think that the self-help exercise to record a “Gratitude” journal each day or each week builds on this idea.)

Conclusions, 408–418

In this book, Kahneman explored “the intuitive System 1, which does the fast thinking, and the effortful and slower System 2, which does the slow thinking, monitors System 1, and maintains control as best it can within its limited resources” (p. 408). He later described “the experiencing self, which does the living, and the remembering self, which keeps score and makes choices” (p. 408). Memory is fallible, and often our utterances, “I’ll never forget this” are proven false within 10 years.

Kahneman says that System 1 focuses on the peak–end rule, ignoring duration when thinking about experiences, but System 2 creates the remembering self. Even so, the remembering self often makes mistakes, neglecting duration, falling prey to hindsight bias, and overemphasizing peak–end experiences. System 2 also relies on the information it has available, in the time available, and the given context. All of these factors limit the effectiveness of System 2 in making decisions. In addition, System 2 is lazy, so it often doesn’t intervene because doing so would require effort, slowing down, working hard, and considering multiple sources of information, not just what is readily available from memory.

Though System 1 is certainly fallible, it acts on our own richly informed knowledge of the world around us, readily identifying unexpected events and surprising situations. Though it often makes mistakes, it acts within fractions of a second to try to figure out the cause of unexpected events, alerting us to possible causes. When based on extensive experience, skills, and expertise, System 1 does quite well most of the time — which is lucky because we rely on it most of the time for our actions and thoughts. It often quickly generates multiple possible answers to questions and problems, using whatever memories are readily available. Though sometimes these answers are wrong, off the mark, less-than-optimal, they’re right — or at least close to right — quite often, too.

Humans are subject to a multitude of cognitive errors, especially when under time pressures, when distracted, or when subject to intense emotions. Because we are fallible, good public policy wouldn’t dictate ways to avoid making poor decisions, but it would nudge us to make better decisions. An example would be that when a person begins a new job, the default option would be to join a pension plan. The new employee could still actively opt out, but if the person does nothing, she or he will automatically be enrolled in a plan to save through a pension plan. Richard Thaler and Cass Sunstein call this choice architecture, structuring our choice options to make it more likely that we will choose the one that’s better for us and for our community.

Another example would be that an employee would automatically increase the amount of savings whenever the employee’s income increases. So, with each pay raise the employee is automatically increasing her or his contribution to a savings plan. As with the pension plan, the employee could take action to opt out of the increase, but if the employee took no action, the savings would increase.

Another example: Insist that food labels such as “90% fat free” would be accompanied by a label stating “10% fat,” in a comparable size and text.

Kahneman readily acknowledges, “my intuitive thinking is just as prone to overconfidence, extreme predictions, and the planning fallacy as it was before I made a study of these issues. I have improved only in my ability to recognize situations in which errors are likely . . . . And I have made much more progress in recognizing the errors of others than my own” (p. 417). So true of all of us! He warns us, “questioning your intuitions is unpleasant when you face the stress of a big decision” (p. 417).

Appendix A: Judgment under Uncertainty: Heuristics and Biases, 419–432

by Amos Tversky and Daniel Kahneman

The two psychologists introduce the concepts of representativeness, availability, adjustment and anchoring, and other heuristics.

Appendix B: Choices, Values, and Frames, 433–448

by Daniel Kahneman and Amos Tversky

The pair discusses “the cognitive and psychophysical determinants of choice in risky and riskless contexts” (p. 433). In it, they observe how people show risk aversion in relation to gains but risk seeking in relation to losses.

Notes, 449–481

Notes for each chapter are tagged by page number and the phrase to which the note applies.

Acknowledgments, 483

Kahneman opens by stating, “I am fortunate to have many friends and no shame about asking for help” (p. 483).

Index, 485–499

Copyright © 2025, Shari Dorantes Hatch. All rights reserved.

Leave a comment